Food Industry’s Performance in Jan. ~ Oct.

By CnAgri2014-01-14 09:57:10

By CnAgri2014-01-14 09:57:10 Print

Print

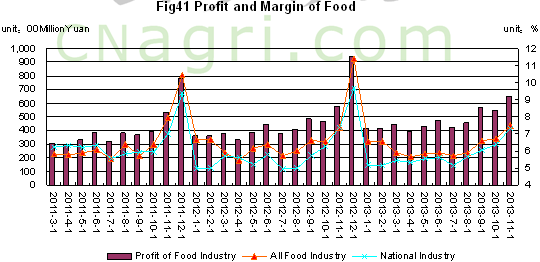

According to statistics, in Jan.~Oct., capital gain rate of large scaled food industry was higher than other industries but its operating profit margin was lower than all industries if government tax preference was excluded. The high capital gain rate and operating profit margin promoted rapid growth of investment, favorable for price stability and decline of residents’ living costs.

The food industry’s assets registered RMB4.82499 trillion, accounting for 5.87% of total industry assets, of which RMB2.7023 trillion was liquid assets, accounting for 6.56% of total liquid assets. The food industry’s debt ratio was 50.99%, further decline from last month. Its quick ratio was 54.93%, 1.12 times more than the nation’s average level. With fall grain list and purchase increase of agricultural products, proportion of liquid asset and the quick ratio were promoted up.

The food industry’s total assets and liquid assets increased 17.9% and 16.7% respectively in Nov. on the year-on-year basis, far higher than the nation’s industrial average level of 13.5% and 12.0%. Debt ratio declined 0.3% and quick ratio declined 1.3%.

The food industry’s revenue from main business was RMB8.31711 trillion, up 15.3% YOY, accounting for 9.00% of total industry revenues and profit from main business was RMB522.66 billion, up 14.4% YOY, accounting for9.80% of total industry profit. The food industry’s tax payment was RMB270.77 billion, up 13.7% YOY, accounting for 13.7% of total industry tax payment. Profit and tax payment totaled 793.43 billion Yuan, accounting for 8.53% of total industry profit and tax payment.

Revenue of agro-food processing industry was 5.33549 trillion yuan, ranking 6th.

In general, food industry has high value of investing by generating high ratio of profit and tas with low ratio of asset. Raise of capital organic composition will help improve enterprise’s competitiveness.

Industrial operation and capital operation efficiency: The food industry’s profit ratio was 6.28% in Jan. ~ Nov., 9% more than the nation’s industrial average. The food industry’s ratio of profit and tax payment against its total assets was 16.13%, 45%more than the nation's industrial average, far higher than other industries’ gain. The food industry’s total asset turnover and liquid asset turnover were 1.69times and 3.08 times respectively in Jan. ~ Nov., 53% and 37% more than the nation's industrial average respectively. High level of turnovers improved capital efficiency and asset’s profitability.

The food industry’s total cost of production was RMB7.94905 trillion in Jan. ~ Nov.,accounting for 8.87% of total industries’ costs, of which RMB7.06602 trillion were the cost of main business, accounting for 8.93% of total industries’ main business costs. The food industry’s marketing expense, management expense and financial expense added up to RMB615.26 billion, 9.44% of total industries’ costs. The food industry’s marketing expense accounted for 14.94% of total industries’ marketing expenses with 334.03 billion yuan, management expense, 6.81% with 216.04 billion yuan and financial expense 5.71% with 62.19 million yuan. Of the financial expenses, 57.8 billion yuan was payed as bank loan interests, accounting for 5.71%.

For the cost structure, main business cost accounted for 88.89% of total costs, of which, main business cost of agro-food processing industry accounted for 93.00%. The food industry’s marketing expense, management expense and financial expense accounted for 7.7% totally, higher than industry average level of 7.2%. Marketing expense accounted for 4.20%, 68% more than average industry level, of which, marketing expense in food manufacturing and drink industry accounted for 7.89% and 8.48% respectively. Management expense and financial expense accounted for 2.72% and 0.73% respectively.

To improve brand influence, higher ad costs are payed, which influences market competitiveness. Brand nutrition depends on stable products quality, well after-sale services and convenient delivery service etc., short-termed ads do less help.

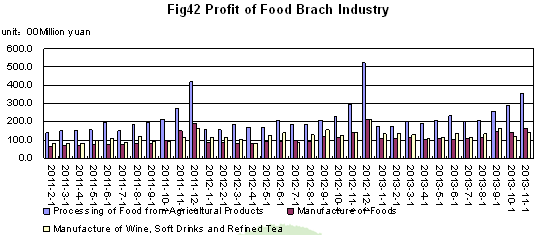

Monthly profit: national industry profit totaled RMB707.48 billion in Nov., a growth of 10.80% on the year-on-year basis, of which, the food industry attained a profit of RMB65.25 billion in Nov., a growth of 13.46% on the year-on-year basis. For different food varieties: total profit of agro-food processing industry was RMB35.6 billion, food manufacturing industry, RMB15.81 billion and drink industry, RMB13.84 billion, up 21.13%, 12.05% and -1.21% respectively from last month.

In all manufacturing industries, agro-food manufacturing industry ranks sixth in terms of total profit, thereby, it has high value of investing.

Monthly profit margin: profit margin of industry and food industry was 7.36% and 7.49% in Nov.. Of food industry, profit margin of agro-food manufacturing, food manufacturing and drink processing was 6.24%, 9.56% and 10.19% respectively.

From “China Grains Market Weekly Report”

Recommended Reports »

- China’s Fertilizer Market Review & Outlook Outline (2013/2014)

- China Fruit (Vegetable) Juice & Beverage Market Review & Outlook 2013/2014

- Review and Outlook of China’s Dairy Industry 2013/2014

- China Feed Market Review & Outlook 2013-2014

- China Feed Additives Market Review & Outlook 2013-2014

- China Livestock Market Review & Outlook 2013 /2014

- Report on Operation and Investment Strategy of China’s Fresh Food E-commerce Industry

- China’s Rice Processing Industry Competition and Development Countermeasures

- Report on Application of D40, D70 & D90 in the Market of Formula Milk Powder

- Depth Analysis of China Broiler Chicken Market Status in 2013

Most Popular »

- World Peanut Production in 2012

- Top 20 Soybean Importers in December, 2012

- Government to Subsidize Poultry Industry

- China Soybean Stocks in Ports on Nov. 29th

- China Soybean and Palm Oil...

- Cargill to invest $48m in...

- Sumitomo Chemical’s joint ...

- Ag Committees Members Win,...

- Fruit & Vegetable Import in March

- Adjustment of Fertilizer Export Policy in 2014

- International Sulfur Price Further up

- Senate Proposes Higher 'Junk Food' Tax

- Drinking Water in Bottles and Barrels

- Fruit and Vegetable Consumption in 2012