December Domestic Corn Prices Would Face Relatively Great Downward Pressure

By CnAgri2018-12-06 15:22:42

By CnAgri2018-12-06 15:22:42 Print

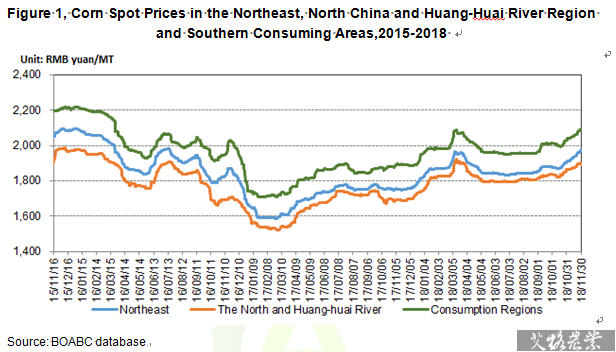

Since new corn availability on the market, influenced by a delay of corn availability on the market, farmers’ unwillingness to sell, a great expansion of further processing capacity and an increase in purchase prices of further processing, corn market prices have ascended greatly, of which corn prices witnessed an increase of more RMB 100/MT in the northeast. Driven up by an increase in corn prices in the producing areas, corn prices in the consumption areas all climbed up. But, it was predicted corn prices in the producing and consumption in December would face increasingly downward pressure.

Print

Since new corn availability on the market, influenced by a delay of corn availability on the market, farmers’ unwillingness to sell, a great expansion of further processing capacity and an increase in purchase prices of further processing, corn market prices have ascended greatly, of which corn prices witnessed an increase of more RMB 100/MT in the northeast. Driven up by an increase in corn prices in the producing areas, corn prices in the consumption areas all climbed up. But, it was predicted corn prices in the producing and consumption in December would face increasingly downward pressure.First, the supply of corn on the market possibly would increase. The temperature in the northeast in November was relatively high, which is not good for corn freezing and threshing and delays the progress of corn availability on the market. Along with a fall in temperature in December, more corn would be available on the market. After December, northeastern farmers would get to the stage of paying loans, and some farmers with relatively great fund pressure would start to sell grain for paying loans. Besides, there are still 50 million MT of temporally-stored corn stored in temporarily depots in the northeast, as well as traders and intermediate logistics companies, which would be sped up to be available on the market because of relatively high market prices.

Second, the demand for corn has been weak. Most of large feed enterprise groups have established the warehouses in the northeast, and corn stocks can meet the demand in 2-4 months; along with the increasing of corn prices, feed companies who purchase corn in the consumption areas also take the strategy of buying on a hand-to-mouth basis.

Third, improving trade relations between China and U.S. possibly would push down the costs of corn and substitutes and push up the imports. At the G20 summit, China and the U.S. promised to stop increasing tariffs in 2019. Along with improving trade relations, additional tariffs possibly would be canceled. It means the costs of imported corn and sorghum arrival at the ports range at RMB 2,160-2,180/MT. After the cancellation of 25% import tariffs, the costs would decrease to RMB 1,760-1,770/MT, far less than corn spot prices of RMB 2,000/MT at the ports of Guangdong, which would push down domestic corn prices.

Recommended Reports »

- Study Report on the Development of China's Ternary Compound Fertilizer Industry

- Competitiveness Analysis and Assessment for China Key Compound Fertilizer Enterprises

- Analysis and Forecast on China Vegoils & Oilseeds Industry (2016-2017)

- Analysis and Forecast on China Fertilizer Industry (2016-2017)

- Analysis and Forecast on China Feed Industry (2015-2016)

- Analysis and Forecast on China Livestock Industry (2015-2016)

- Research Report on Water Soluble Fertilizer Market in China

- Research Report on Slow and Controlled Release Fertilizers Application and Industry Development in China

- Analysis Report on Potash Fertilizer Demand in China

- Analysis Report on Phosphate Fertilizer Demand in China

Most Popular »

- Average Price of Yellow Phosphorus in China

- Shuangbaotai Group Cuts Feed Price

- FRESH.JD.com to Use Global...

- Ethanol Futures Fall to Lowest Since July

- Top 20 Soybean Importers in December, 2012

- Price of Cotton by Products

- There is Big Difficulty in...

- Heilongjiang Xinhecheng Biol...

- Sugar Situation in Guangxi

- Amount of Phosphorite Minin...

- Benzoic Acid Exports By Month

- The Problem of Threonine O...

- Guangdong Yihao Food invest...