China Rice Production and Paddy Balance Sheet in Dec. 2013

By CnAgri2014-02-18 09:25:55

By CnAgri2014-02-18 09:25:55 Print

Print

Keywords:China Rice Production paddy consumption

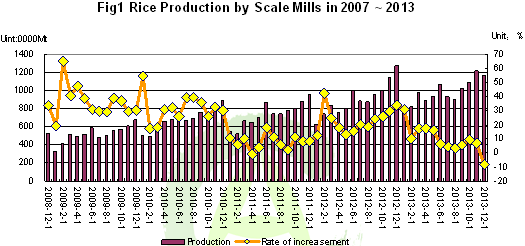

Statistics Bureau: rice production decreased both YOY and MOM in large scaled(Note: annual sales income registering over 20 million yuan. Hereinafter the same) rice mills in Dec.Rice production by medium and large mills registered 11.7221 million MT in Dec., calculated by historical data, it was 8.09% less than the month before and 3.7% less than the same period of last year. It is peak season for rice processing and consumption and the production keeps high. Rice production totaled 11.8462 million MT in Jan. ~ Dec., an increase of 8.55% on the year-on-year basis. (Note: according to published data, the monthly growth rate was -1.10% and accumulative production, 117.688 million MT, up 10.25% YOY). At the rice/paddy ratio of 68%, medium and large mills consumed 17.238million MT paddy in Dec. and 174.209 million MT in Jan. ~ Dec.

Deducting repetitive statistics and taking into account of rice production by small mills, BOABC estimates that rice production and paddy consumption were about 12.284 million MT and 18.065 million MT respectively in Dec..

In Dec., taking 30 days operation as full capacity, the average operating rate was 36.6%, of which, small mills ran at 16.5% operating rate with production of 1.97 million MT and medium and large mills 40.6% with production of 10.32 million MT. In 2012, taking 350 days operation as full capacity, the total capacity of processing paddy was 577 million MT as estimated by BOABC, of which, capacity of medium and large mills was 423 million MT and small mills 153 million MT.

Paddy consumption for various uses was estimated to be 20.028 million MT in Dec. Rice imports and exports were 208,000 MT and 22,000 MT respectively in Dec., equal to 306,000 MT paddy and 33,000 MT paddy respectively. Rice imports in Jan.-Dec. totaled 2.244 million MT, converted to paddy was 3.3 million MT, lower than the 3.45 million MT in 2012.

Integrating harvest, consumption and imp.&Exp., paddy inventory was 181 million MT at the end of Dec., suggesting a monthly consumption index of 9.1, both above the same period of last year, attributable to increased rice imports.

At the end of Dec., new paddy purchased by enterprises in major production areas registered 61.75 million MT, increasing 17.61 million MT from the same period last year, of which, 24.73 million MT was keng rice and 27.33 million MT was mid-late rice, increasing 8.67 million MT and 8.03 million MT respectively on year-on-year basis. 30.9083 million MT is predicted to be purchased by state-owned enterprises, 30.84 million MT by private enterprises., up 5.889 million MT and 11.73 million MT respectively YOY. Paddy inventory in Dec. consisted of 74.75 million MT state reserve, 13.55 million MT rice mills’ stock, 13.9 million MT traders’ stock and 78.76 million MT farmers’ stock. 62.89% of farmers’ harvested paddy has been sold.

Rice, keng rice, mid-late rice and early Indica rice prices were RMB2,813/MT, RMB3,068/MT RMB2,730/MT and RMB2,641/MT respectively in Dec., up 3.43%, 7.68%, 1.82% and 0.48% respectively on the year-on-year basis. The prices were RMB2,779/MT, RMB3,042/MT RMB2,656/MT and RMB2,641/MT respectively in July-Dec., up 1.24%, 4.26%, -2.44% and 1.70% respectively on the year-on-year basis.

Influenced by reserves policy, price for keng rice and mid-late indica rice saw certain increase. Mid-late rice price declined.

Planted paddy acreage and paddy production are about 30.73 million hectares and 205.1 million MT in 2013/2014, up 1.97% and 0.43% respectively on the year-on-year basis. Paddy consumption and year-end inventory are estimated to be 208 million MT and 84.23 million MT, suggesting a safety index of 42.85%. Influenced by price difference, rice imports still keep high, reaching 3.286 million MT. Small scaled planting is the key factor constraining agricultural productivity.

Rice safety index ran at a high level. Though supported by protective procurement price, annual prices for new crops increased to RMB2827/MT with growth rate of 2.8%, of which, prices for keng rice, mid-late rice and early indica rice were RMB2966/MT, RMB2783/MT and RMB2702 respectively, up 2.5%, 3.00% and 3.5% respectively.

From “China Grains Market Weekly Report”

Recommended Reports »

- China’s Fertilizer Market Review & Outlook Outline (2013/2014)

- China Fruit (Vegetable) Juice & Beverage Market Review & Outlook 2013/2014

- Review and Outlook of China’s Dairy Industry 2013/2014

- China Feed Market Review & Outlook 2013-2014

- China Feed Additives Market Review & Outlook 2013-2014

- China Livestock Market Review & Outlook 2013 /2014

- Report on Operation and Investment Strategy of China’s Fresh Food E-commerce Industry

- China’s Rice Processing Industry Competition and Development Countermeasures

- Report on Application of D40, D70 & D90 in the Market of Formula Milk Powder

- Depth Analysis of China Broiler Chicken Market Status in 2013

Most Popular »

- Top 20 Soybean Importers in December, 2012

- World Peanut Production in 2012

- Adjustment of Fertilizer Export Policy in 2014

- Lysine Price Finally Rebounded

- Fertilizer Price Trend in Jan.20-26 2014

- Average Price of Yellow Phosphorus in China

- Senate Proposes Higher 'Junk Food' Tax

- Spot Price of Shelled Peanuts and Peanut Oil

- Coca-Cola Promoted New Orga...

- China Breeding Livestock an...

- China Soymeal Price Down w...

- Profit Comparison between B...

- Fruit and Vegetable Consumption in 2012

- China’s Frozen Beef Import...