China Rice Planting Profit Analysis in 2013 and Outlook in 2014

By CnAgri2014-01-20 09:36:51

By CnAgri2014-01-20 09:36:51 Print

Print

According to NDRC’s accounting of agricultural products cost-benefit and BOABC’s market monitoring, the planting profit of rice kept declining. Based on current price trend, the profit is expected to decline further more in 2014, which may influence planting acreages. To guarantee food supply and grain safety, new protective price and policy should be carried out.

According to announcement of NDRC, the profit margin of planting rice was 27.08% in 2012, lowest level since 2004.

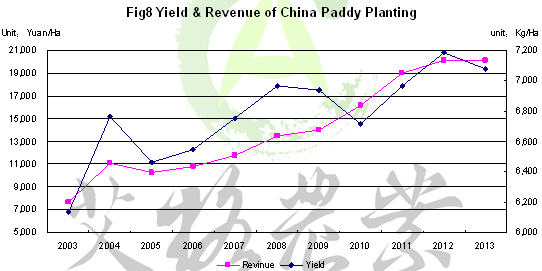

In 2012, unit yield of rice was 7181Kg/hectare, up 6.18% compared with 2004 and the CAGR was 1.01%, lowest among the three major grains. Compared with advanced countries, unit yield in America was 8743Kg/hectare in 2012 and its output was 1.22 times more than China.

Rice price from farmers was RMB2761/MT in 2012, up 72.89% compared with 2004 with CAGR of 7.09%; unit output value was RMB20112/hectare, up 83.26% compared with 2004 with CAGR of 7.90%. The profit increase was driven by price increase. But the cost also saw rapid growth. Total costs reached RMB17100/hectare in 2012, up 132% from 2004, with CAGR of 11.1%. Specifically, the CAGR of labor cost, land cost and material and service cost were 12.30%, 15.06% and 9.08% respectively. Growth rate of costs outstripped that of rice price, resulting in significant decline of rice planting profit margin. As for rapid growth of planting cost, it was mainly caused by the continuous inflation since 2004.

Influenced by drought in Yangtze River areas in 2013, unit yield of rice is forecast to decline by 1.47%. As for price, it rose 1.24% in July-Dec. 2013 compared with the same period in 2012, far lower than the level in advance countries. Based on the growth rate, price from farmers is forecast at RMB2769/MT and unit output value is RMB20070/hectare, down 0.21%.

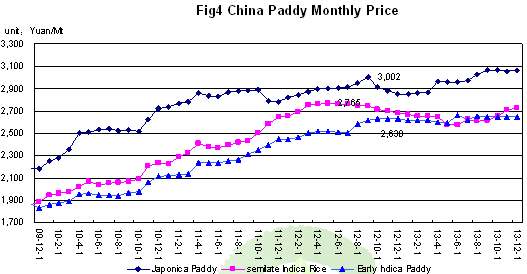

Factors influencing rice price: large amounts of low priced southeast Asian imports brought significant blow to indica rice market; frequent exposure of cadmium rice in SC and its fermenting influenced mid-late indica rice market; high level of rice production drove domestic rice safety index to increase; besides, RMB appreciation to some extent also triggered imports increase and exports decline. According to BOABC’s market monitoring, price for mid-late rice declined 2.44%.

Cost analysis: agricultural materials costs declined during the stage of rice growth. Average price of fertilizer declined 4.42%. Specifically, ABC down 3.67%, urea down 7.27%, potassium chloride down 6.10%, NPK down 4.99% and superphosphate down 0.06%. Unit fertilizer cost was RMB1894/hectare, down 5.47%. Though surplus, seed cost still increased 5% to RMB761/hectare. In general, costs for material and service, land and labor were RMB7109/hectare, RMB3045/hectare and RMB6949/hectare respectively, with growth rate of 4.50%, 16.01% and 8.58% respectively YOY. Unit net profit was RMB2968/hectare with profit margin of 17.35%, slumping 56.82%, lowest since 2002.

For different varieties, profit margin for early rice, middle rice, late indica rice and keng rice was 12.98%, 35.12%, 24.97% and 33.05% respectively in 2012 and was 14.04%, 21.48%, 10.36% and 28.18% respectively in 2013.

With significant decline of rice planting profit margin, grain planting acreage will be challenged in 2014.

Influences of protective procurement price: protective procurement price for keng rice, mid-late rice and early indica rice was RMB3000/MT, RMB2700/MT and RMB2640/MT respectively with growth rate of 7.14%, 8.00% and 10.00% respectively. Based on the growth rate, average price from farmers should reach RMB2992/MT in 2013. Farmers’ planting profit/cost rate was 25.51%, basically close to the same level in 2012, which to some extent was good for stability of rice planting acreage. But the profit is still lower than government’s expectation. So government should enhance credit supports to rice processing and reserving enterprises so as to promote rice price to increase by facilitating circulation.

In overall, in 2012, rice production reached 30.137 million hectares, output value was 606.1 billion yuan, planting cost was 477 billion yuan and farmers’ planting profit was only 129.2 billion yuan. Based on current price level, in 2013, rice output value totals 616.7 billion yuan, planting cost is 525.5 billion yuan, planting profit is 91.2 billion yuan, down 29.39% from 2012.

As for input of materials and service, in 2012, consumption of seeds, fertilizer and agricultural film totaled 11.01 million MT, specifically, consumption of seeds was 1.24 million MT, fertilizer 9.63 million MT and agricultural film 0.14 million MT, up 3.65%, -0.13% and 3.71% respectively from 2011; in 2013, the consumption is estimated to be 1.28 million MT, 9.63 million MT and 0.14 million MT respectively with growth rate of 3.10%, -0.04% and 0.89% respectively YOY.

In 2012, market value of materials and service reached 205 billion yuan, up 11.07% from 2011, specifically, market value of seeds, fertilizer, pesticide, agricultural film and agricultural service was 21.8 billion yuan, 60.4 billion yuan, 22.1 billion yuan, 2 billion yuan and 81.7 billion yuan respectively, up 13.95%, 7.86%, 10.29%, 7.31% and 12.98% respectively YOY. In 2013, market value of materials and service was 218.4 billion yuan, up 6.55%from 2012, specifically market value of seeds, fertilizer, pesticide, agricultural film and agricultural service was 23.4 billion yuan, 58.2 billion yuan, 23.7 billion yuan, 2 billion yuan and 91.8 billion yuan respectively, up 7.07%, -3.61%, 7.07%, -0.58% and 11.00% respectively YOY.

In accordance with current rice price, farmers’ planting profit decline will inevitably cause rice planting acreage to decline in 2014. According to BOABC’s estimate, the decline rate was 1-2%.

In 2014, consumption of seeds, fertilizer and agricultural film was 1.26 million MT, 9.83 million MT and 0.13 million MT respectively, with growth rate of -1.09%, 2.03% and -2.14% respectively YOY.

Suggestions: according to Ma Wenfeng, analyst from BOABC, China should increase the retirement pension of rural labors, who have reached retirement age, to accelerate land transfer to younger labors, so as to increase planting acreage of single labor and thereby improve income of rural labors and achieve sustainable increase of grain production.

From “China Grains Market Weekly Report”

Recommended Reports »

- China’s Fertilizer Market Review & Outlook Outline (2013/2014)

- China Fruit (Vegetable) Juice & Beverage Market Review & Outlook 2013/2014

- Review and Outlook of China’s Dairy Industry 2013/2014

- China Feed Market Review & Outlook 2013-2014

- China Feed Additives Market Review & Outlook 2013-2014

- China Livestock Market Review & Outlook 2013 /2014

- Report on Operation and Investment Strategy of China’s Fresh Food E-commerce Industry

- China’s Rice Processing Industry Competition and Development Countermeasures

- Report on Application of D40, D70 & D90 in the Market of Formula Milk Powder

- Depth Analysis of China Broiler Chicken Market Status in 2013

Most Popular »

- World Peanut Production in 2012

- Top 20 Soybean Importers in December, 2012

- Government to Subsidize Poultry Industry

- China Soybean and Palm Oil...

- Adjustment of Fertilizer Export Policy in 2014

- Cargill to invest $48m in...

- Fruit & Vegetable Import in March

- Sumitomo Chemical’s joint ...

- Ag Committees Members Win,...

- International Sulfur Price Further up

- Analysis on Import of Infa...

- Fruit and Vegetable Consumption in 2012

- Senate Proposes Higher 'Junk Food' Tax

- Coca-Cola Promoted New Orga...