China Flour Production and Wheat Balance Sheet in Dec. 2013

By CnAgri2014-02-19 09:43:24

By CnAgri2014-02-19 09:43:24 Print

Print

Keywords:China Flour Production wheat consumption

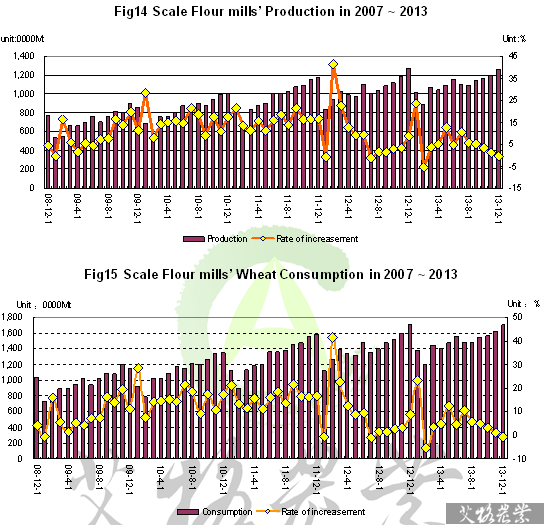

According to statistics data, flour production by medium and large sized enterprises decreased YOY but decreased MOM in Dec.. Boom season for flour consumption has come, bring production increase in December.Flour production by medium and large mills registered 12.6538 million MT in Dec., calculated by historical data, it was 0.63% less than the same period of last year and 5.4% more than the month before . Rice production totaled 132.405 million MT in Jan. ~ Dec., an increase of 5.23% on the year-on-year basis. (Note: according to published data, the monthly growth rate was -2.91% and accumulative production, 132.04 million MT, up 4.17% YOY). Thereby, medium and large mills consumed 17.1 million MT wheat in Dec. and 178.93 million MT in Jan. ~ Dec.

Deducting repetitive statistics, BOABC estimates that flour production and wheat consumption were about 7.47 million MT and 10.094 million MT respectively in Dec.. In 2013, flour production and wheat consumption is 78.16 million MT and 105.62 million MT respectively.

In Dec., taking 30 days operation as full capacity, the average operating rate of flour enterprises was 50.7%, of which, small enterprises ran at 33.1% operating rate with production of 4.4 million MT and medium and large mills 52.5% with production of 7.03 million MT. In 2012, the total capacity of processing wheat was 235.5 million MT , of which, capacity of medium and large enterprises was 215 million MT and small enterprises 21.38 million MT.

Wheat consumption for various uses was estimated to be 10.895 million MT in Dec., of which, consumption for seeds in SC was 136,000MT. Rice imports were 389,000 MT and 5.507 million MT respectively in Dec. and Jan.-Dec.. Wheat import is estimated to be 5.86million MT in 2013/14, significantly more than previous expectation of 4.75 million MT. Wheat inventory was 81.537 million MT at the end of Dec., suggesting a stock index of 7.5, both higher than the same period of last year, which restrained the market significantly. It was the major reason causing recent wheat price to decline.

In Dec., wheat purchased with protective procurement price and for temporary reserves auctioned 4.01 million MT with turnovers of 2.99 million MT, mostly export of good quality wheat in Henan. 4.733 million MT grains were de-stocked; as for new grain purchase, most were imported for state reserves. The inventory consisted of 44.11 million MT state-owned enterprises’ stock, 12.11 million MT flour mills’ stock, 3.5 million MT traders’ stock and 20.76 million MT farmers’ stock. 83.71% of farmers’ new wheat was sold, far lower than the same period of last year.

Wheat price was RMB2,548/MT in Dec. and RMB2,480/MT in May ~ Dec., up 9.09% and 12.19% respectively on the year-on-year basis. Grain price will keep relatively high later influenced by national policy. Wheat price will drop with impacts of macro economy and large amounts of imports.

In 2013/14, wheat production declined with unfavorable weather condition though planting acreages saw increase. Wheat production is estimated to be 119.6 million MT in 2013/2014, down 1.15% on the year-on-year basis. Besides, production of wheat suitable for flour making declined greatly, causing demand increase for wheat imports. In view of high price, wheat consumption for feed declined to 4 million MT. Wheat consumption is predicted to be 119 million MT in the whole year. Year-end wheat inventory is predicted to be 48.02 million MT, suggesting a safety index of 40.4%. Wheat price may keep high later, averaging RMB2,490/MT in the year, up 10% on the year-on-year basis.

Domestic good quality wheat production was 70.97 million MT, 62.39 million MT of which flew to market. Besides, increase of wheat imports also gave rise to good quality wheat supply, registering 87.56 million MT, 63 million MT of which was used for making flour and 24.423 million MT was year-end inventory, suggesting a safety index of 38.66%.

In 2014/15, winter wheat acreage is estimated to be 22.632 million hectares and spring wheat acreage is predicted to be 1.738 million hectares, up 0.42% and 6.16% respectively on the year-on-year basis influenced by price increase. Total acreage is 24.37 million hectares, up 0.81% YOY. Wheat production is predicted to be 124.7 million MT , up 4.25% on the year-on-year basis. Year-end inventory and safety index were 53.39 million MT and 44.0% respectively. Driven by increase of protective procurement price, wheat price in new crop year shall keep increasing to RMB2589/MT with growth rate of about 4%.

In 2014/15, good quality wheat production shall increase significantly to 85.504 million MT, 70.97 million MT of which will be consumed. Year-end inventory and safety index are 31.07 million MT and 46.86% respectively, both saw a staggering increase.

From “China Grains Market Weekly Report”

Recommended Reports »

- China’s Fertilizer Market Review & Outlook Outline (2013/2014)

- China Fruit (Vegetable) Juice & Beverage Market Review & Outlook 2013/2014

- Review and Outlook of China’s Dairy Industry 2013/2014

- China Feed Market Review & Outlook 2013-2014

- China Feed Additives Market Review & Outlook 2013-2014

- China Livestock Market Review & Outlook 2013 /2014

- Report on Operation and Investment Strategy of China’s Fresh Food E-commerce Industry

- China’s Rice Processing Industry Competition and Development Countermeasures

- Report on Application of D40, D70 & D90 in the Market of Formula Milk Powder

- Depth Analysis of China Broiler Chicken Market Status in 2013

Most Popular »

- Top 20 Soybean Importers in December, 2012

- World Peanut Production in 2012

- Adjustment of Fertilizer Export Policy in 2014

- Fertilizer Price Trend in Jan.20-26 2014

- Lysine Price Finally Rebounded

- Average Price of Yellow Phosphorus in China

- Fruit and Vegetable Consumption in 2012

- Senate Proposes Higher 'Junk Food' Tax

- Spot Price of Shelled Peanuts and Peanut Oil

- Profit Comparison between B...

- Coca-Cola Promoted New Orga...

- China Breeding Livestock an...

- China Soymeal Price Down w...

- Coffee Import by Country and Province in February