China Rice Production & Paddy Consumption in Sept. 2013

By CnAgri2013-11-01 10:55:29

By CnAgri2013-11-01 10:55:29 Print

Print

Rice production by medium and large mills registered 10.132 million MT in China in Sept. and 83.634 million MT in Jan. ~ Sept., 5.57% and 11.53% more than the same period of last year respectively. At a rice/paddy ratio of 68%, medium and large mills consumed 14.944 million MT paddy in Sept. and 122.99 million MT in Jan. ~ Sept.

Deducting repetitive statistics and taking into account of small mills’ production, BOABC estimates that the nation’s rice production and paddy consumption might be 10.275 million MT and 15.111 million MT respectively in Sept. Small mills ran at 11.2% of their capacity and medium and large mills 35.2% in Sept.

Paddy consumption for various uses was about 17.05 million MT in Sept. Rice imports and exports were 142,700 MT and 36,400 MT respectively in Sept.

Paddy inventory was 134 million MT at the end of Sept., suggesting a monthly consumption index of 7.9, both above the same period of last year, attributable to increased rice imports. The inventory consisted of 57.35 million MT state reserve, 11.33 million MT rice mills’ stock, 11.5 million MT traders’ stock and 53.84 million MT on-farm stock.

Paddy procurement in major production regions was 11.33 million MT by the end of Sept., of which 6.194 million MT were procured by state-run companies.

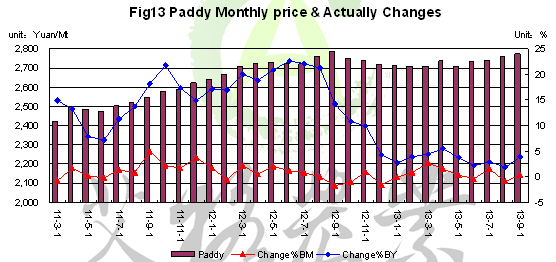

Japonica, semilate paddy and Indica prices were RMB3,060/MT, RMB2,605/MT and RMB2,645/MT respectively in Sept., up 2.1%, down 5.01% but up 1.2% respectively on the year-on-year basis.

Planted paddy acreage and paddy production are estimated to be 30.696 million hectares and 205.5 million MT respectively in 2013/2014, up 1.58% and 0.58% respectively on the year-on-year basis. Rice imports equal to 3.8 million MT paddy. Paddy consumption and year-end inventory are predicted to be 207.6 million MT and 89.184 million MT respectively, bringing up safety index to 43.07%.

Under the support of the government’s protective procurement policy, Japonica, semilate paddy and Indica prices are presumed to move up 2.5%, 4% and 3% respectively this year on the year-on-year basis, reaching RMB2,986/MT, RMB2,783/MT and RMB2,685/MT respectively.

From “China Grains Market Weekly Report”

Recommended Reports »

- Report on Operation and Investment Strategy of China’s Fresh Food E-commerce Industry

- China’s Rice Processing Industry Competition and Development Countermeasures

- Report on Application of D40, D70 & D90 in the Market of Formula Milk Powder

- Depth Analysis of China Broiler Chicken Market Status in 2013

- Report on China’s Raw Milk Powder Market Supply and Demand

- Research Report on Infant Formulas Market in China

- China’s Whey Products Market Research Report

- Analysis and Research Report on Rapeseeds and Rapeseed Meal Market

- Research Report on China's Premix Feed Market

- Report on China’s Sesame Market in 2013

Most Popular »

- Fruit and Vegetable Consumption in 2012

- Lysine Price Finally Rebounded

- Profit Comparison between B...

- Flour Production & Wheat Consumption in 2012

- Spot Price of Shelled Peanuts and Peanut Oil

- China Fruits Export in 2012

- Rice Production and Paddy ...

- Sales Revenue of Top 20 S...

- World Cotton Production To Decline in 2013/14

- China’s Chicken Offal Imports & Exports in 2012

- Report on China’s Raw Mil...

- Fertilizer Export Control Loosened

- China’s Imports of log by...

- China’s Top 20 Soybean Importers in March