Domestic Oilseed Processing Industry May Be Reshuffled

By CnAgri2017-03-27 09:37:57

By CnAgri2017-03-27 09:37:57 Print

Print

In January 2017, the State Council issued the notice concerning several measures about expanding the opening to the active use of foreign capital and clearly canceled the admittance restriction of foreign capital oilseed processing. Foreign-owned enterprises have increased investments in the oilseed processing industry in China, the oilseed processing industry is likely to be reshuffled.

Starting from this year, Louis Dreyfus and Shandong Bohi signed an agreement and they planned to set up a grain and oil processing base in Qingdao of Shandong; Cargill and New Hope Group jointly invested on a soybean crushing project in Cangzhou of Hebei; Dongguan Shenheng Grain & Oil Corp’s oil plant is about to be put into production invested by Bunge, and so on. The biggest advantage of the foreign oilseed processing enterprises: the controlling ability over the overseas oilseed resources and the international oilseed trade. If their oilseed processing ability increases by a large margin in China, the living space of domestic oilseed processing enterprises will continue to be compressed.

Domestic soybean crushing enterprises are expanding capacity, for example, China Grain Reserves Corp set up an industrial park in Panjin; after Huifu Grain & Oil Corp’s plant was put into production in Taizhou, it intends to set up a large soybean crushing enterprise in Panjin and Cangzhou of Hebei; China Sea Grain & Oils Industry Corp intends to set up a oilseed processing plant in Zhenjiang, and so on. It is very important for the domestic enterprises to expand capacity but they may face greater risks without the controlling ability over the overseas oilseed resources.

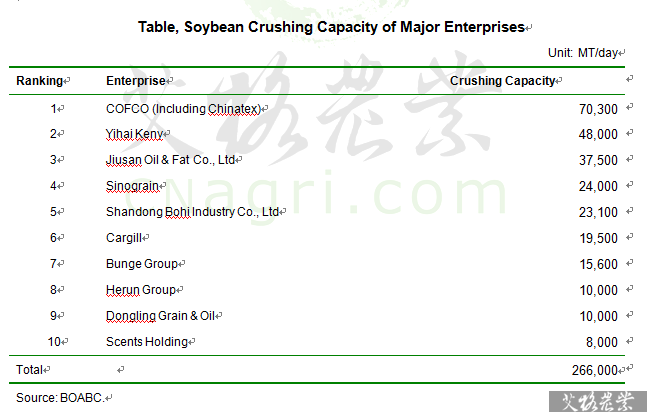

As for the current domestic soybean crushing enterprises, Cofco’s international trade capacity and crushing capacity have improved significantly after it merged into Noble Agri and Chinatex. Cofco has become the largest soybean crushing enterprise group in China and its daily processing capacity is 70,000 tons, accounting for 15% of the national total capacity. And the processing capacity of the enterprises such as Jiusan Group, Sinograin, Bohai, Herun has expanded significantly in recent years but they are still in the relatively passive position in controlling the trade of raw materials.

Recommended Reports »

- Analysis and Forecast on China Juice Industry (2016-2017)

- Analysis and Forecast on China Sugar Industry (2016-2017)

- China Fruits and Vegetables Market Report

- Soft Drink

- Analysis and Forecast on China’s Dairy Industry (2016/2017)

- Century Dairy

- China Fertilizer Investment Research Quarterly Report

- Market Size, Competition Pattern and Future Development Forecast of China Animal Vaccine Market

- Market Size, Competition Pattern and Future Development Forecast of China Pet Health Market in 2016

- China livestock industry weekly report 20160829:Market potential of PVC2 vaccine is huge, reaching 3.5 billion yuan

Most Popular »

- Top 20 Soybean Importers in December, 2012

- World Peanut Production in 2012

- The world's largest Perfume...

- Urea Price Decreased and...

- Average Price of Yellow Phosphorus in China

- Hog price has been 20.86 ...

- China Canceled the Control...

- Analysis of monthly imports...

- Analysis on Import of Infa...

- Retail Prices of Liquid Milk in May

- Video Conference on Rural ...

- Benzoic Acid Exports By Month

- Canada to grant continued ...