If the listing of hog futures can be free of “hog cycle” featuring sharp fluctuations of prices?

By CnAgri2017-09-14 09:43:13

By CnAgri2017-09-14 09:43:13 Print

Print

Keywords:If the listing of hog futures can be free of “hog cycle” featuring sharp fluctuations of prices?

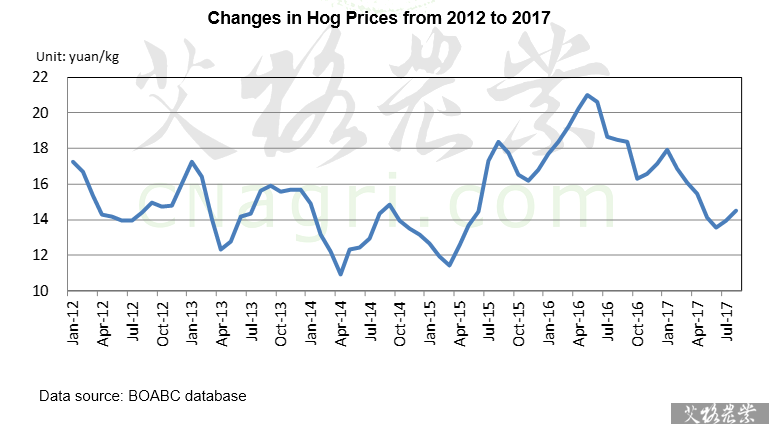

China's Dalian Commodity Exchange has designed a scheme with live hog as object of transaction in 2006, but it was difficult to conduct futures delivery due to non-standardization of hog market. If hog futures are listed later, can hog market be free of “hog cycle”featuring sharp fluctuations of prices?In 2016, China slaughtered about 685 million hogs, reaching a market scale of over 1.1 trillion yuan. From the historical point of view, sharp fluctuations of hog prices have brought about huge impact on the production and operation of hog farming enterprises. For many years, it’s hard for farming enterprises to be free of “hog cycle”featuring sharp fluctuations of prices, which is may be caused by following two seasons:

One reason is blocked market information. The changes in supply and demand relationship is the root cause for hog price changes. Currently, hog transaction mainly is conducted by hog wholesalers in China, it’s hard for farming enterprises to learn real and accurate market information of demand side and grasp the overall market dynamics, so their production decisions are blind to some extent, leading extremely unstable production.

The second season is that the market lacks risk management tool. Generally, farming enterprises avoid the market risks caused by hog price decline through reducing production cost and developing upstream and downstream industrial chains, but these measures can’t fundamentally solve problem for lacking effective risk hedge tool. In addition, hog price insurance company can’t largely promote insurance for lacking suitable risk diversification channel and facing adverse selection risk from insurance applicants.

Theoretically, as a risk management tool, hog futures can help farmers timely learn future hog market trend to lower fluctuations through forward cooperation price, however, China’s futures market is in the early stage of development and nonstandard operation is possible to aggravate market fluctuation. As for the situation in the first half of 2017, although egg futures have been listed, the fluctuation range of egg prices still exceeded expectation, having huge impact on layer feeding.

So, we should be too optimistic about that if the listing of hog futures can help hog market be free of “hog cycle”featuring sharp fluctuations of prices.

Recommended Reports »

- Investment Research Report on China Fruit Juices & Drinks Market

- Special Import and Export Data Report

- Analysis and Forecast on China Juice Industry (2016-2017)

- Analysis and Forecast on China Sugar Industry (2016-2017)

- China Fruits and Vegetables Market Report

- Soft Drink

- Analysis and Forecast on China’s Dairy Industry (2016/2017)

- Century Dairy

- China Fertilizer Investment Research Quarterly Report

- Market Size, Competition Pattern and Future Development Forecast of China Animal Vaccine Market

Most Popular »

- Profit Comparison between B...

- Top 20 Soybean Importers in December, 2012

- Top 10 Chinese Log Importe...

- World Peanut Production in 2012

- Fruit and Vegetable Consumption in 2012

- Retail Prices of Liquid Milk in May

- The New VAT rate would de...

- China Cotton Production in 2012

- Canada to grant continued ...

- Average Price of Yellow Phosphorus in China

- Consumer Price Index (CPI) by Region (2013.01)

- Sugar Situation in Guangxi

- Why is ADM Setting up an...