The sharp drop in hog prices will accelerate the increase in the scale of hog farming

By CnAgri2018-05-23 11:07:32

By CnAgri2018-05-23 11:07:32 Print

Currently, hog market is sluggish, and hog prices are hovering around 10yuan/kg, which is consistently lower than the industry cost line of 13yuan/kg. Pig industry has fully fallen into a loss. Raising self-propagated hogs averagely suffers a loss of 219yuan/head, and the profit of fattening outsourcing piglets is -296yuan/hog. Continuous decline in hog prices or will accelerate the elimination of backward production capacity in the market, and further promote the development of scale farming.

Print

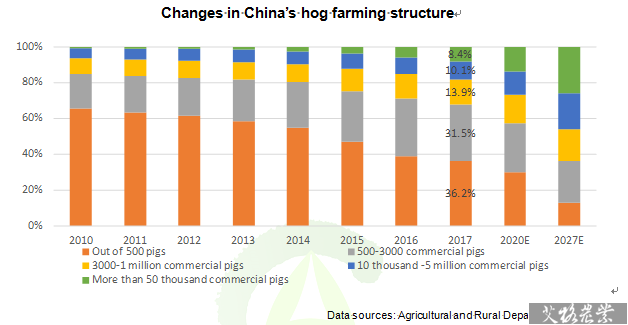

Currently, hog market is sluggish, and hog prices are hovering around 10yuan/kg, which is consistently lower than the industry cost line of 13yuan/kg. Pig industry has fully fallen into a loss. Raising self-propagated hogs averagely suffers a loss of 219yuan/head, and the profit of fattening outsourcing piglets is -296yuan/hog. Continuous decline in hog prices or will accelerate the elimination of backward production capacity in the market, and further promote the development of scale farming.In recent years, environmental protection policies have become stricter, the backward production capacity has been eliminated, and the scale degree of the industry has been greatly improved. At the end of 2017, there were 340 million hogs on hand and 35 million farmers in China (according to the statistics of the Ministry of Agriculture and Rural Affairs, there were 42.61 million farms in 2016 and 49.54 million farms in 2015), and the average inventory of a single farm was about 10 head. The proportion of farms each with an inventory of more than 500 hogs was about 64%, seeing a significant growth compared with the 35% in 2010; Top 10 enterprises accounted for 6.7% of the slaughter, up 1.62% year-on-year.

However, compared with the United States, the space for the integration of China's hog industry is still very large. The United States has 733 million hogs on hands annually and 68,000 farms, so the average inventory in a single farm is more than 1,000 head. The inventory of farms which respectively have more than 5000 hogs on hands accounts for 61% of the total, and proportion of farms each with an inventory of more than 1000 hogs is up to 94%.

The decrease in hog prices is sharp in this round, and the cycle has been extended compared to the past. In the future, scale farming of hogs will be accelerated in China. It is estimated that by 2025, domestic large-scale and super-scale farming enterprises will account for about 45% of the total inventory, medium and small-sized farms will make up about 40%, and individual farmers will account for some 15%.

Recommended Reports »

- China Mid-to High-end Vegoils Development Potential, Operation Model and Investment Prospect

- Analysis on Development Potential, Operating Models and Investment Prospects of China’s Beef Cattle Industry

- Analysis on China’s Cheese Market, Potential and Investment Prospect

- Yearbook on China's Agricultural Products (2017)

- China Broiler Industry Research and Investment Analysis Report (2017-2018)

- Analysis and Forecast on China’s Feed Industry (2017-2018)

- Proposal of Report on Growth and Investment of China’s Dairy Industry (2017-2018)

- China’s Oils & Oilseed Industry and Investment Analysis Report (2017-2018)

- China’s Hog Industry and Investment Analysis Report(2017-2018)

- China’s Fertilizer Industry and Investment Analysis Report(2017-2018)

Most Popular »

- A small rebound in pig pr...

- Top 10 Chinese Log Importe...

- World Peanut Production in 2012

- The New VAT rate would de...

- An increase of 25% tariff...

- SGS acquire Dutch firm Ware Care Group

- Average Price of Yellow Phosphorus in China

- Haid’s Haiyang Haid Feed ...

- BASF posted strong sales result in Q2

- Shuangbaotai Group Cuts Feed Price

- Consumer Price Index (CPI) by Region (2013.01)

- Sugar Situation in Guangxi

- 8.62 million Tons New Suga...