A Back-Door Listing and Business Development are Main Reasons for Twins Group’s Acquisition of Jinxinnong

By CnAgri2018-05-30 09:41:22

By CnAgri2018-05-30 09:41:22 Print

On May 21st, Jinxinnong announced that it planed to transfer a 29.9% stake to Jiangxi Twins, with the trading amount of 1.934 billion RMB.

Print

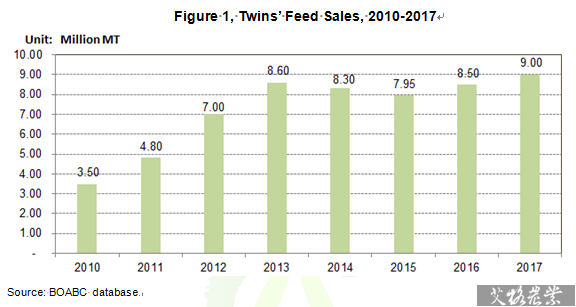

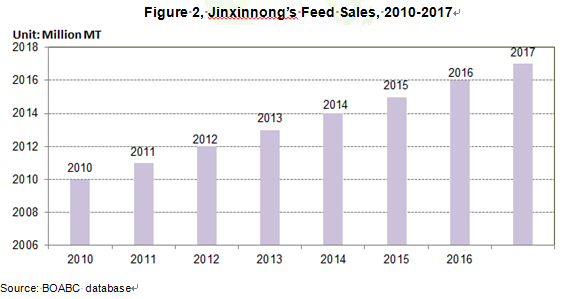

On May 21st, Jinxinnong announced that it planed to transfer a 29.9% stake to Jiangxi Twins, with the trading amount of 1.934 billion RMB.Twins is China’s biggest hog feed producer. It has owned more 100 subsidiaries, with annual feed capacity of more 20 million MT. Twins’ feed sales in 2017 reached 9 million MT. Jinxinnong is mainly engaged in feed, hog farming and animal health. Of which Jinxinnong’s feed sales in 2017 were 0.77 million MT, hog production stood at 0.37 million heads, and the revenues of feed business accounted for 75%. Twins’ acquisition of Jinxinnong is mainly because of listing and business development.

Due to great fluctuations about operating revenues of Agro-pastoral industry and stricter management and control on IPO, no agro-pastoral company has been successfully listed for a year. Through acquisition, back-door listing is the only feasible way.

Besides, the acquisition of Jinxinnong also conforms to the developmental strategy of Twins. Twins planned to achieve feed sales at 20 million MT within five years, hog production at 15 million heads and grain purchasing and storage at 16 million MT. Twins’ feed products have been selling to large pig farms; the sales of feed sold to large pig farms by Jinxinnnong have reached up to 65%. More importantly, Xinjinnong has acquired domestic famous breeder companies such as Henan Xinda, Fujian Yichun and Wuhan Tianzhong, and hog farming business is developing quickly. In 2017, Jinxinnong advanced the construction of hog farming projects in Tieli of Heilongjiang, Nanping of Fujian and Shixing of Guangdong, etc., and planned to build half-million-head farming projects in Xipign of Henan and Jinghan of Hubei. It is helpful for the goal of hog production at 2 million heads/year in the next three years.

Recommended Reports »

- China Fruit Market Research Monthly Report

- Research Report on China’s Corn Seed Industry 2015

- China Mid-to High-end Vegoils Development Potential, Operation Model and Investment Prospect

- Analysis on Development Potential, Operating Models and Investment Prospects of China’s Beef Cattle Industry

- Analysis on China’s Cheese Market, Potential and Investment Prospect

- Yearbook on China's Agricultural Products 2017

- China Broiler Industry Research and Investment Analysis Report (2017-2018)

- Analysis and Forecast on China Feed Industry (2017-2018)

- Report on Growth and Investment of China’s Dairy Industry (2017-2018)

- China’s Oils & Oilseed Industry and Investment Analysis Report (2017-2018)

Most Popular »

- The sharp drop in hog pri...

- A small rebound in pig pr...

- Top 10 Chinese Log Importe...

- World Peanut Production in 2012

- The New VAT rate would de...

- SGS acquire Dutch firm Ware Care Group

- Shuangbaotai Group Cuts Feed Price

- Average Price of Yellow Phosphorus in China

- An increase of 25% tariff...

- The structure of GP whiter...

- Top 20 Soybean Importers in December, 2012

- Nongfu Spring Packed Water in “Standard Gate”

- Haid’s Haiyang Haid Feed ...