Why Didn’t Water Soluble Fertilizer Prices Ascend With Increasing Fertilizer Prices?

By CnAgri2018-01-17 10:31:42

By CnAgri2018-01-17 10:31:42 Print

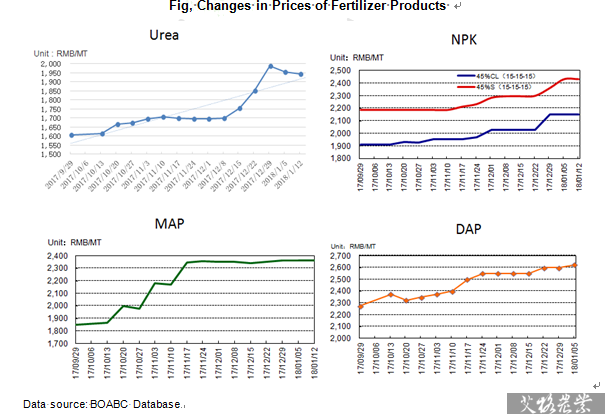

Since October, fertilizer prices have ascended greatly. Of which urea and MAP prices increased by 400-500 RMB/MT; DAP and potassium chloride prices were up 250-300 RMB/MT; 45% S-based NPK prices increased by 120 RMB/MT. But, the prices of water soluble fertilizer almost stabilized, and main water soluble fertilizer companies such as Shanghai Fangdian and Yongtong didn’t adjust their quotations. The main reasons are as follows:

Print

Since October, fertilizer prices have ascended greatly. Of which urea and MAP prices increased by 400-500 RMB/MT; DAP and potassium chloride prices were up 250-300 RMB/MT; 45% S-based NPK prices increased by 120 RMB/MT. But, the prices of water soluble fertilizer almost stabilized, and main water soluble fertilizer companies such as Shanghai Fangdian and Yongtong didn’t adjust their quotations. The main reasons are as follows: (1) Except for common materials such as N-fertilizer, P-fertilizer and K-fertilizer for water soluble fertilizers, various secondary and micro-nutrients are added according to purposes and functions. Due to a big gap between the prices of pure natural and synthetic nutrient elements, there is wide room for profits and low degree of sensitivity to water soluble companies.

(2) Along with planting structure being adjusting in recent years, the planting areas of fruit and vegetable cash crops increase greatly, but a rapid increase in output makes the prices go down sharply, such as blueberries and kiwis, so the demand for high-end fertilizer from farmer households reduces.

(3) Along with more and more companies entering water soluble fertilizer production and sales sectors, the competitiveness is fierce increasingly. In order to occupy the market, the companies must maintain certain price advantage, so they won’t adjust their quotations easily.

Recommended Reports »

- China Broiler Industry Research and Investment Analysis Report (2017-2018)

- Proposal of Analysis and Forecast on China’s Feed Industry (2017-2018)

- Report on Growth and Investment of China’s Dairy Industry(2017-2018)

- China’s Oils & Oilseed Industry and Investment Analysis Report (2017-2018)

- China’s Hog Industry and Investment Analysis Report(2017-2018)

- China’s Fertilizer Industry and Investment Analysis Report(2017-2018)

- China Layer Industry Research and Investment Analysis Report

- China Beef Cattle Industry Investment Analysis Report(2017-2018)

- Analysis and Investment on China Sugar Industry (2017-2018)

- Cheese Supply and Demand, Competition Pattern and Forecast

Most Popular »

- Insecticide India Q2 net falls 3%

- Cheese Retail Enjoys Big Potential in China

- GMO Certificate Management ...

- Top 20 Soybean Importers in December, 2012

- Top 10 Chinese Log Importe...

- Average Price of Yellow Phosphorus in China

- Nongfu Spring Packed Water in “Standard Gate”

- Flour Production & Wheat Consumption in 2012

- Agricultural Materials Retai...

- Beef consumption demand is...

- Total Retail Sales of Cons...

- EU completes new rules for...

- Consumer Price Index (CPI) by Region (2013.01)