Owing to Much Pressure, Fertilizer Production Margins in 2018 Wouldn’t be Optimistic

By CnAgri2018-04-28 10:12:55

By CnAgri2018-04-28 10:12:55 Print

Along with policies of environmental protection and capacity reduction, listed fertilizer companies saw a great increase in performance in 2017; but, along with the cancellation of preferential policies, the tightening of environment-friendly resource, the adjustments on downstream demand and increasing pressure of costs, fertilizer companies still faced the problems such as a drop in margins, etc.

Print

Along with policies of environmental protection and capacity reduction, listed fertilizer companies saw a great increase in performance in 2017; but, along with the cancellation of preferential policies, the tightening of environment-friendly resource, the adjustments on downstream demand and increasing pressure of costs, fertilizer companies still faced the problems such as a drop in margins, etc. (1) Along with strict environmental policies, operating costs increase. Strict environmental policies would continue for three years from 2018, and chemical material prices possibly would maintain at a high level. Since the collection of environmental protection taxes from April 1st, 2018, production costs have increased. Taking urea for example, the costs increase by 20-30 RMB/MT due to an increase in environmental protection taxes. However, due to sluggish terminal markets, fertilizer companies won’t shift the costs directly to customers.

(2) Along with the reducing of dealers and the increasing of direct selling, the companies face increasing risks of selling. Selling channel always is the model “producer-dealer-retailer-terminal farm household”. But, along with the expanding of scale in recent years, the number of scaled farm households in 2017 approached to 4.5 million in 2017, and the proportion of direct selling is gradually improving, around 5%-10% now. The producers would face more selling pressure and more investment in terminal markets. For example: Kingenta’s selling expenses in 2017 reached 1.456 billion RMB, up 43.06% year on year; Wintrue and Batian both saw a great year-on-year increase in expenses for management and selling.

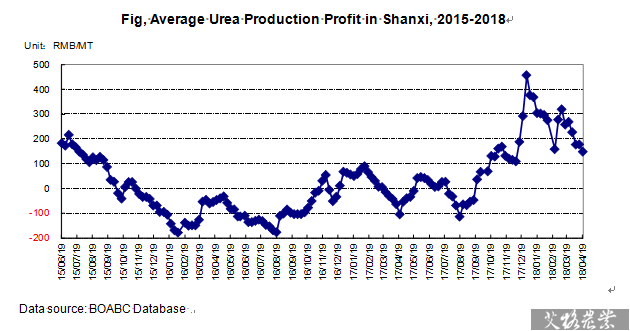

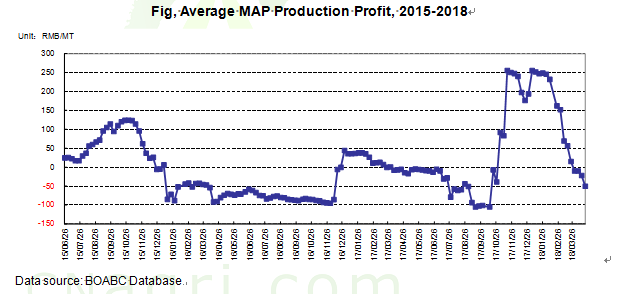

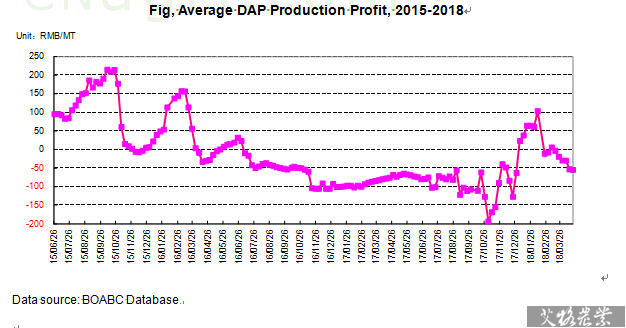

(3) Fertilizer market runs in reverse and the profits narrow. Fertilizer market has seen the phenomenon of a growth in prices in off season and a fall in prices in busy season in recent years. For example: in off season (winter) of consumption of 2017, fertilizer prices increased by 100 RMB/MT, but in busy season (spring ploughing) of consumption of 2018, fertilizer prices dropped greatly, of which the quotations of urea, 55% powdery MAP, and 60% MOP decreased by 120 RMB/MT, 219 RMB/MT and 50 RMB/MT respectively. It means that fertilizer producers produce high-cost products in off season of consumption, which narrows the profits.

Besides, judging from current production profits, urea and P-fertilizer producers both see decreasing profits, and even P-fertilizer companies fall into loss. It was predicted that fertilizer companies’ operation wouldn’t be optimistic in 2018.

Recommended Reports »

- Yearbook on China's Agricultural Products (2017)

- Proposal of China Broiler Industry Research and Investment Analysis Report (2017-2018)

- Proposal of Analysis and Forecast on China’s Feed Industry (2017-2018)

- Proposal of Report on Growth and Investment of China’s Dairy Industry (2017-2018)

- China’s Oils & Oilseed Industry and Investment Analysis Report (2017-2018)

- China’s Hog Industry and Investment Analysis Report(2017-2018)

- China’s Fertilizer Industry and Investment Analysis Report(2017-2018)

- China Layer Industry Research and Investment Analysis Report

- China Beef Cattle Industry Investment Analysis Report(2017-2018)

- Analysis and Investment on China Sugar Industry (2017-2018)

Most Popular »

- The New VAT rate would de...

- China imposes an additional...

- The world's largest Perfume...

- Dairy Production totaled 4....

- Top 20 Soybean Importers in December, 2012

- Top 10 Chinese Log Importe...

- China-U.S. Soybean Trade Wa...

- Feed Material Prices Showed...

- SGS acquire Dutch firm Ware Care Group

- A small rebound in pig pr...

- Operating status of listed...

- World Peanut Production in 2012

- An increase of 25% tariff...