Main Listed Fertilizer Companies’ Performance in 2017 Improved Obviously

By CnAgri2018-01-17 10:36:50

By CnAgri2018-01-17 10:36:50 Print

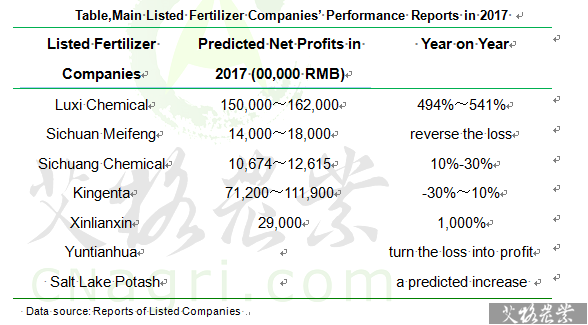

Currently, main listed fertilizer companies all have published the reports on performance in 2017. Except for several companies, most fertilizer companies saw an increase in profits or turned loss into profit, and even some fertilizer companies predicted that their net profits should increase by more 1,000% year on year. Of which Luxi Chemical’s net profits reached 1.5-1.6 billion RMB, 5 times as many as 2016; Sichuan Meifeng’s net profits recorded 150 million RMB; Kingenta’s net profits stood at 900 million RMB; Xinlianxin’s net profits were 290 million RMB; Sichuan Chemical’s net profits were around 100 million RMB. Main listed fertilizer companies in 2017 all saw obvious improvements in performance compared to 2016.

Print

Currently, main listed fertilizer companies all have published the reports on performance in 2017. Except for several companies, most fertilizer companies saw an increase in profits or turned loss into profit, and even some fertilizer companies predicted that their net profits should increase by more 1,000% year on year. Of which Luxi Chemical’s net profits reached 1.5-1.6 billion RMB, 5 times as many as 2016; Sichuan Meifeng’s net profits recorded 150 million RMB; Kingenta’s net profits stood at 900 million RMB; Xinlianxin’s net profits were 290 million RMB; Sichuan Chemical’s net profits were around 100 million RMB. Main listed fertilizer companies in 2017 all saw obvious improvements in performance compared to 2016. BOABC’s analysts think there are two main reasons for obvious improvements in performance of listed fertilizer companies:

First, listed fertilizer companies are optimizing the structure of main products. Influenced by a downturn of fertilizer industry in 2016, listed fertilizer companies started to optimize the structure of main products with relatively high profits, for example: in the first half of 2017, Sichuan Meifeng cut down urea production and changed to produce the products with high profits, such as ammonia; Xinlianxin increased NPK production, and cut down urea production, and meanwhile it completed the layout of urea production and purchased competitive anthracite.

Second, fertilizer prices in the fourth quarter of 2017 ascended greatly. Influenced by supply and demand relation, fertilizer market prices in the fourth quarter of 2017 all ascended greatly: urea quotations from main producers averaged 1,950 RMB/MT, with an increase of 400 RMB/MT; MAP ex-factory prices reached 2,350 RMB/MT, with a growth of 500 RMB/MT; 64% DAP ex-factory prices averaged 2,550 RMB/MT, with an increase of 250 RMB/MT; 60% MOP prices arrival at stations recorded 2,150 RMB/MT, with a growth of 300 RMB/MT; 45% S-based NPK ex-factory prices averaged 2,432 RMB/MT, with an increase of 120 RMB/MT. Urea companies’ profits were the best, of which the net profits of Luxi Chemical were nearly 4 times higher than 2016.

Recommended Reports »

- China Broiler Industry Research and Investment Analysis Report (2017-2018)

- Proposal of Analysis and Forecast on China’s Feed Industry (2017-2018)

- Report on Growth and Investment of China’s Dairy Industry(2017-2018)

- China’s Oils & Oilseed Industry and Investment Analysis Report (2017-2018)

- China’s Hog Industry and Investment Analysis Report(2017-2018)

- China’s Fertilizer Industry and Investment Analysis Report(2017-2018)

- China Layer Industry Research and Investment Analysis Report

- China Beef Cattle Industry Investment Analysis Report(2017-2018)

- Analysis and Investment on China Sugar Industry (2017-2018)

- Cheese Supply and Demand, Competition Pattern and Forecast

Most Popular »

- Insecticide India Q2 net falls 3%

- Cheese Retail Enjoys Big Potential in China

- GMO Certificate Management ...

- Top 20 Soybean Importers in December, 2012

- Top 10 Chinese Log Importe...

- Average Price of Yellow Phosphorus in China

- Nongfu Spring Packed Water in “Standard Gate”

- Flour Production & Wheat Consumption in 2012

- Agricultural Materials Retai...

- Beef consumption demand is...

- Total Retail Sales of Cons...

- EU completes new rules for...

- Consumer Price Index (CPI) by Region (2013.01)