Kingenta’s Operating Revenues in 2017 Saw a Limited Growth, and Net Profits Have Dropped for two Consecutive Years

By CnAgri2018-04-28 10:24:29

By CnAgri2018-04-28 10:24:29 Print

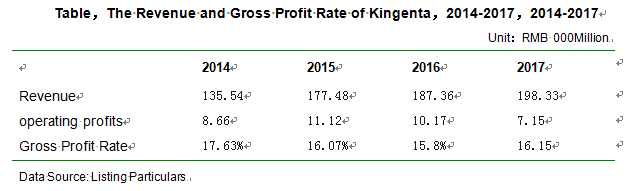

Recently, according to 2017 annual report, operating revenues in 2017 registered 19.833 billion RMB, up 5.86% year on year; net profits stood at 715 million RMB, down 29.7% year on year. Along with a great increase in the whole fertilizer industry, Kingenta’s operating revenues have seen only a growth of 5% for two consecutive years, and net profits have decreased greatly for two consecutive years.

Print

Recently, according to 2017 annual report, operating revenues in 2017 registered 19.833 billion RMB, up 5.86% year on year; net profits stood at 715 million RMB, down 29.7% year on year. Along with a great increase in the whole fertilizer industry, Kingenta’s operating revenues have seen only a growth of 5% for two consecutive years, and net profits have decreased greatly for two consecutive years.(1) Judging from specific business, the revenues of Kingenta’s five products:common compound fertilizer, water soluble fertilizer, controlled release fertilizer, nitro-based fertilizer and material fertilizer accounted for 86.5% of total revenues in 2017, of which operating revenues of common compound fertilizer increased by 5.96% year on year, and operating revenues of water soluble fertilizer, controlled release fertilizer, nitro-based fertilizer and material fertilizer decreased by 33.17%, 13.27%, 29.68% and 0.16% respectively. Seen in the perspective of region, operating revenues in the east, central and north took up 76.7% in the total revenues, but all saw a drop of 2%-5%. However Kingenta’s selling expenses in 2017 reached up to 1.456 billion RMB, up 43.1% year on year.

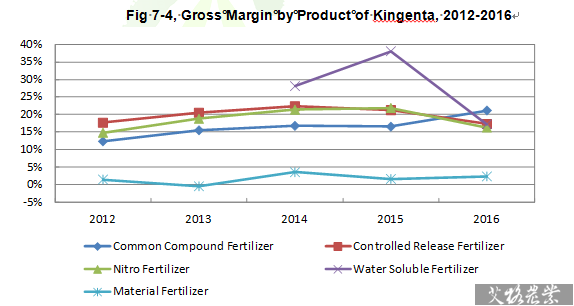

(2) Kingenta’s gross margin rates of marketing average at 16%-17%, but, since 2016, the gross margin rate of main fertilizer products has decreased, of which the gross margin rate of slow/controlled release fertilizer, nitro-based fertilizer and water soluble fertilizer had decreased by 8.7%, 1.03% and 15.5%.

Facing a dilemma, Kingenta is actively exploring new marketing and service models. In 2015, Kingenta invested 2 billion RMB in creating Agricultural Material E-business Platform No. 1, which stopped operation in the second half of 2017; Jindong Flagship Store also closed down, so it had relatively great losses.

Recommended Reports »

- Yearbook on China's Agricultural Products (2017)

- Proposal of China Broiler Industry Research and Investment Analysis Report (2017-2018)

- Proposal of Analysis and Forecast on China’s Feed Industry (2017-2018)

- Proposal of Report on Growth and Investment of China’s Dairy Industry (2017-2018)

- China’s Oils & Oilseed Industry and Investment Analysis Report (2017-2018)

- China’s Hog Industry and Investment Analysis Report(2017-2018)

- China’s Fertilizer Industry and Investment Analysis Report(2017-2018)

- China Layer Industry Research and Investment Analysis Report

- China Beef Cattle Industry Investment Analysis Report(2017-2018)

- Analysis and Investment on China Sugar Industry (2017-2018)

Most Popular »

- The New VAT rate would de...

- China imposes an additional...

- The world's largest Perfume...

- Dairy Production totaled 4....

- Top 20 Soybean Importers in December, 2012

- Top 10 Chinese Log Importe...

- China-U.S. Soybean Trade Wa...

- Feed Material Prices Showed...

- SGS acquire Dutch firm Ware Care Group

- A small rebound in pig pr...

- Operating status of listed...

- World Peanut Production in 2012

- An increase of 25% tariff...